Raise Details

-

Gross Offering$800,000 USD

-

Available Units1.50

-

Minimum Investment$10,000 USD

-

Maximum Investment$800,000 USD

-

Open DateMar 15,2022

-

Closing DateMar 30,2022

-

Investment TypeFirst Mortgage

-

Maturity12 months

-

Real Estate UseResidential

-

Maturity End DateMar 31,2023

Type

| Type | Number of Units | Available Units | Cost per Unit | Payback Per Unit | Gross Offering | Annual Yield | Effective Yield | Term |

|---|---|---|---|---|---|---|---|---|

| Series B | 8.00 | 1.50 | $75,532.00 USD | $100,000.00 USD | $800,000.00 USD | 24.47% | 32.39% | 12 months |

| Totals | 8.00 | 1.50 | $800,000.00 USD |

Executive Summary

Overview:

Chesterfield Faring Ltd. is making an investment of $4.42 million subordinated “B” note to purchase the $10.55 million first mortgage loan land loan secured by Challenger 60, a 173,085 SF development site situated across from Samsung US HQ in Ridgefield Park, Bergen County, NJ. The Loan will be increased to $13.92 million per a Loan modification described herein.

The Background:

Chesterfield was engaged to buy the first mortgage in December 2021 by the current borrower, Challenger 60 LLC (the “Borrower”). The Borrower agreed if Chesterfield bought the Loan by a newly formed affiliate, aka the Company, the Borrower would engage in a Loan modification making the purchase worthwhile for Chesterfield. That includes increasing the interest rate from 12.5% per annum to 17.0% per annum. Using the leverage of the Note Financing, the net effective annual rate is 32.39% to you as a Subscriber

The Investment:

The Company is offering a total investment of $4,427,512 less prepaid interest for one (1) year. The prepaid interest is $1,083,300 or 32.39% per annum on the net amount funded of $3,344,212. The Offering is divided into a Series A and Series B investment. You are purchasing a face amount Series B for $800,000 for $604,260 for a profit of $195,740 for one (1) year. The Series B is divided into eight (8) $100,000 units at a cost of only $75,532.53 per Unit totaling the $604,260. The interest rate may be decreased to 24.46% if repaid within six (6) months for a full payment then by the Borrower at a pre-agreed discount for early repayment.

Senior Loan:

CFL is arranged $9.5 million financing (the “Financing”) as a senior Loan position from a lender at 10.5% per annum (or $997,500 prepaid) for one (1) year in advance. The Financing shall be one (1) year. The closing points will be 1.0% of the Financing plus out of pocket costs. The Financing request is 30.0% Financing to land value, 70.33% Financing to unpaid principal balance, and $8.05 per buildable PSF.

Takeout Financing:

This is a short-term one (1) year bridge loan. The Loan will be repaid by a $200.0 million construction loan. CFL is arranging the Takeout Loan.

The Property:

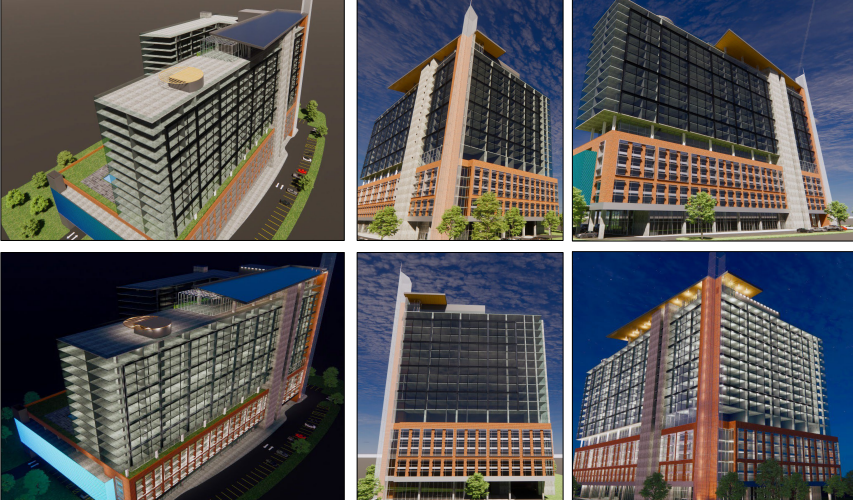

The Site is approved and entitled to build 1,117,831 SF as a 19-story building with 679,594 GSF as 552 apartments (10% affordable, 90% free market). The affordable housing is required to receive a PILOT reducing real estate taxes to zero for 25 years. The Building will have 341,751 GSF allocated for 920 parking spaces (Floors 2-6,) plus 34,298 GSF of retail space (1ˢᵗ Floor). The Site is valued at $30.0 million ($26.84 PSF buildable). This is one of the wealthiest counties in New Jersey being only 12 minutes by car to Manhattan. The Property is in the Overpeck Corporate Center, Bergen County's preeminent business center and the headquarters of Samsung North America. The Property is directly adjacent to I-95 and Route 6, while I-80 is located directly north of the site. New York City is accessed via the George Washington Bridge 5 miles to the east) and the Lincoln Tunnel (9.5 miles to the south), and nearby public transit including train and buses operated by NJ Transit.

Borrower(s):

The Rinaldi Group (“TRG”) is the developer and contractor of the Property. TRG is based in Secaucus, NJ. Notable projects can be viewed at rinaldinyc.com/projects. The firm is headed by Anthony Rinaldi, who previously worked for the George Fuller company. He constructed The Residences at Ritz Carlton, a $500-M Hotel/Condo-Tower in White Plains, NY; and at Trump Tower, New Rochelle, part of a $750-M downtown urban redevelopment plan at Le Count Square. Sturm Asset Management LLC (“SAM”) is a New York-based private real estate development corporation. SAM specializes in commercial and multi-family property development In NY, NJ, and Connecticut. Recent Class A multifamily rental developments in NJ include Queensgate in Somerset, plus The Grande at Metropark in Woodbridge (lease up completed July 2021). SAM will be a limited member.

Highlights

- First Mortgage Series B

- 12 minute drive by car to New York City - Manhattan

- PILOT program reducing taxes to zero for 25 years

- 90% Free market units with 10% affordable

Comments

- There are no Comments for this Offering.